| Company | Value | Change | %Change |

|---|

The IPO opens for subscription on Friday, December 20 and closes next Tuesday, December 24.

Carraro India’s parent company, Carraro International S.E. will get all the proceeds of the ₹1,250 crore issue, as the entire IPO is an Offer For Sale (OFS).

Carraro India will not get any proceeds from the issue.

Investors bidding for the issue can apply for one lot of 21 shares and in multiples thereafter, which will entail a minimum investment of ₹14,784.

50% of the IPO has been reserved for Qualified Institutional Bidders (QIB), while 15% of the issue is reserved for non-institutional investors (NIIs). The other 35% is reserved for retail investors.

The allotment of shares and initiation of refunds for the non-allottees will be processed on December 26, and equity shares will be credited to demat accounts on December 27. The company’s stock is expected to list on exchanges on December 30.

The company has appointed Link Intime India Private Limited as the registrar for its public issue.

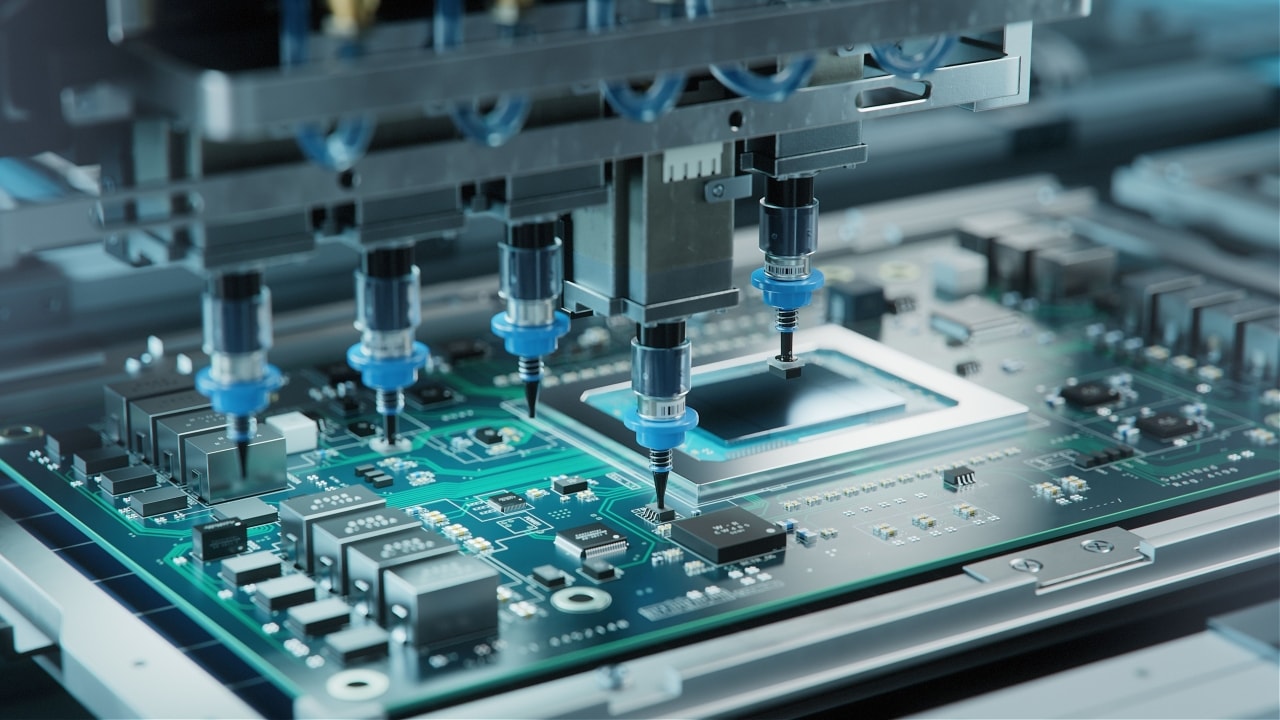

Established in 1997 as a subsidiary of Carraro S.p.A, Carroro India is a tier-1 solution provider of axles, transmission systems and gears for the agricultural tractor and construction vehicle industries in India.

The company began its operations by manufacturing transmission systems in 1999 and axles in 2000. It operates two state-of-the-art manufacturing plants in Pune, focusing on drivelines and gears. These facilities have cutting-edge technologies, including casting, machining, assembly, prototyping, and testing capabilities.

Carraro India has demonstrated steady growth in recent years. Its revenue from operations increased by 4.44% to ₹1,770.45 crore in financial year 2024, compared to ₹1,695.12 crore last year.

Axis Capital Ltd, BNP Paribas, and Nuvama Wealth Management Ltd are the book-running lead managers for the upcoming share sale.