The Nasdaq, on Monday (December 16), closed at a record high of 20,173.74, rising 1.1%, as tech stocks rallied ahead of the Fed’s final policy meeting of the year, while the Dow fell 0.3% and the S&P 500 gained 0.4%.

Tesla Inc shares jumped on Monday (December 16) with the company valuation reaching a $1.5 trillion mark. Analysts have seen a soar in its shares since Trump’s win on November 5, saying that a Trump government could be game changer for Tesla.

Nvidia shares fell on Monday (December 16), officially putting the tech company in correction territory. Despite technology boom, the shares have faced a slow run.

Broadcom shares rose to a record high extending their post-earnings rally. The stock has surpassed or neared price targets set after its strong earnings report, with Bernstein analysts suggesting the company may be having its own “Nvidia moment.” (Image: REUTERS)

Bitcoin has reached an all-time high, above $1,07,000 on December 16. This comes ahead of pending decision by the Federal Reserve on an interest rate cut, expected to be made later this week during its two-day policy meeting.

German Chancellor Olaf Scholz has lost the vote of confidence in the Parliament. This comes after Scholz’s three-party coalition government fell in November. Elections are expected to be held on February 23, 2025. (Image: REUTERS)

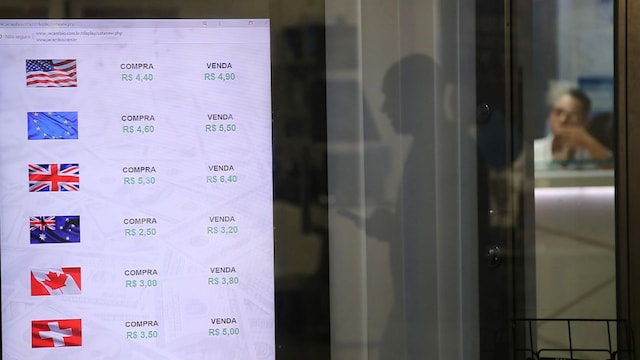

Brazilian currency hit a historic low, losing a fifth of its value this year amid market anxiety over government spending. Central bank interventions briefly eased losses, but rising interest rate bets and President Lula’s criticism of high borrowing costs fueled its decline. (Image: REUTERS)

Argentina’s economy has bounced back from a severe recession in the third quarter of 2024. This comes as a major win for President Javier Milei. The country’s GDP grew 3.9% in Q3, marking its first expansion since entering recession in late 2023.

SoftBank CEO Masayoshi Son pledged a $100 billion US investment over four years, during a visit to President-elect Donald Trump. This is expected to create 1,00,000 AI-related jobs and infrastructure in the States.

Vedanta approved a fourth interim dividend of ₹8.5 per share for FY25, totaling ₹3,324 crore, bringing its total payout for the year to ₹16,799 crore. The record date is December 24, 2024, with payment to follow as scheduled.

SEBI warned HDFC Bank for a three-day delay in disclosing the resignation of its Mortgage Business Group Head, Arvind Kapil, violating Regulation 30(6) of the Listing Obligations and Disclosure Requirements. (Image: REUTERS)

Mankind Pharma, Gravita, and Mindspace REIT have floated QIPs to raise funds. Gravita plans to raise ₹750-1,000 crore at ₹2,096.2 per share with a 5.2% equity dilution. Mankind Pharma aims for ₹3,000 crore at ₹2,520 per share to partly repay debt, diluting equity by 2.9%. Meanwhile, ADIA plans to sell a 9.2% stake in Mindspace REIT via a ₹1,903 crore block deal at ₹350 per unit.

Indus Towers won a favorable ruling from the Income Tax Appellate Tribunal, allowing depreciation claims on assets received during its merger with Bharti Infratel. This decision reduces the company’s contingent liability by around ₹3,500 crore.

LG Electronics plans to launch an IPO for its Indian unit, potentially valued at $15 billion. The company intends to begin the roadshow in the next two months and list in Mumbai by mid-2025, up from its earlier $13 billion valuation target.

The GST Council may increase the tax on used electric vehicles (EVs) and smaller petrol and diesel cars from 12% to 18%, as recommended by its Fitment Committee. This change could make second-hand EVs less attractive by raising their cost in the resale market, while new EVs continue to benefit from a 5% GST rate.