Together, the lack of fiscal push and tight monetary conditions dragged India’s national income growth to a 7-quarter low at the end of September 2024.

However, 2025 may be better. “Fiscal spending is already rising, and the tailwinds from back-ended fiscal spending in FY25 will help the economy regain momentum,” said Neelkanth Mishra, Chief Economist at Axis Bank.

Interest rates are expected to trend down. Most economists expect the first rate in February 2025, after the Reserve Bank of India (RBI) showed its willingness to ease with a cut in cash reserve ratio in December 2024. Lower interest rates lead to lower borrowing costs for companies.

All these factors put together may help India’s gross domestic product grow 7% in the financial year ending March 2026, according to Axis Bank’s outlook for 2025 report released today.

Investment as the key driver

“This is likely to be an investment-driven recovery,” said Mishra, projecting an 8-9% growth in investments and 4.5-5% growth in consumption. “Segments like real estate, construction machinery, and metals, which witnessed significant declines between 2012 and 2021, are now poised for revival,” he added.

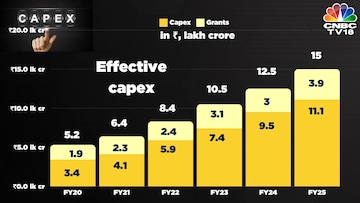

India has been the world’s fastest-growing major economy for a few years now. However, bulk of it has been driven by government’s investments in roads and highways, metro rail, and other such long-term, high-cost public projects. Until this year.

“Generally, the government incurs about 62% of its fiscal deficit in the first half; this year it incurred only 29%, causing a 33% slippage,” Mishra highlighted the slump in government spending before citing a reversal starting October.