The Nifty IT index fell sharply by 2.3%, as comments from Federal Reserve Chair Jerome Powell, signaling a slower pace of rate cuts, weighed on domestic IT sentiment. Meanwhile, the Nifty Metal index outperformed, climbing 1.9% after China announced the withdrawal of export tax rebates on select aluminum and copper products. The move is expected to tighten global supply, benefiting Indian producers.

Besides, Honasa Consumer shares were locked at the 20% lower circuit limit at ₹297.25 following a disappointing earnings report. The stock has declined 30.36% year-to-date, making 2024 a challenging year for the company. Honasa’s total market capitalisation stood at ₹9,655.39 crore on the NSE.

With Q2 earning season coming to a close and FII selling continuing, analysts expect Nifty to consolidate within a broad range due to the absence of any positive trigger.

Tuesday’s trading session will also see the opening of the ₹10,000 crore IPO of NTPC Green Energy. The price band is fixed between ₹102 and ₹108 per share. The offering comprises entirely fresh equity shares with no Offer for Sale (OFS) component. This IPO is the third-largest of 2024, trailing Hyundai Motor India’s ₹27,870 crore issue and Swiggy’s ₹11,300 crore offering.

Click here to know whether you should subscribe to India’s largest public issue.

The stock market will remain closed for trading on November 20 due to the Maharashtra elections.

Foreign institutions continued to remain net sellers in the cash market on Monday although the quantum of their selling was lower, while domestic institutions were net buyers.

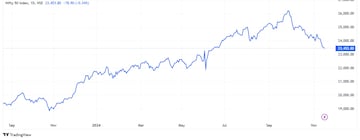

Dhupesh Dhameja of SAMCO Securities said the Nifty opened on a flat note but struggled to gain traction, facing stiff resistance near the 23,600–23,650 range, a zone marked by significant call-writing activity. This triggered a bearish-to-sideways trend for most of the session, culminating in a decline to an intraday low of 23,350.

“The session’s close below the critical 200-DMA highlights waning momentum, with the index showing signs of caution as sellers dominate higher levels. On the daily chart, the index has approached the crucial demand zone of 23,300–23,350. A sustained breach below this range could confirm a bearish continuation, while any rebound must overcome resistance in the 23,900–24,000 range, where heavy call writing reflects strong selling interest,” Dhameja said.

LKP Securities’ Rupak De said that Nifty exhibited some volatility during the day, slipping near a historical congestion level on the daily timeframe. On the daily chart, the index has been trading below the 200-DMA for the past two sessions. The RSI has entered the oversold zone, accompanied by a bearish crossover.

While the overall chart setup remains weak, the selling pressure appears to have eased following a prolonged correction. In the short term, the index may recover towards 23,700–23,800. On the downside, support is positioned at 23,200–23,300, De said.

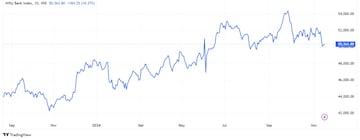

The Nifty Bank opened on a positive tone, maintained bullish momentum despite volatility, and concluded the day on a positive note at 50,364 levels.

“Technically, index on a daily scale has formed a small green candle and and successfully defended the 200-Days exponential moving average (DEMA), indicating strength. The 200-DEMA support is placed near 49,910. If index manages to respect 49,900, then it could witness pullback move towards 50,500-50,600 levels, where the short term trendline resistance is placed. If index sustains above 50,600 levels, the relief rally could extend to 51,000 levels. Overall, the short-term trend is down, but as long as the Bank Nifty holds above 49,900, a pullback rally could possible,” said Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Interrmediates.

Om Mehra of SAMCO Securities said if the Nifty Bank index surpasses 50,550, it could trigger a short-term bounce to 50,900.

However, Mehra said the broader trend remains bearish, with 49,800 acting as immediate support. A breach below this level could deepen the downtrend, pushing the index toward 49,300.