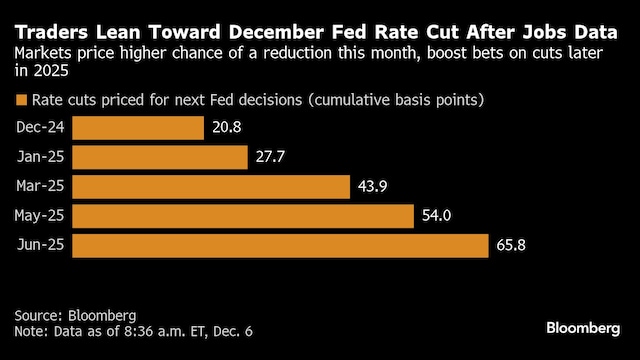

US Treasuries rallied and traders boosted their bets on a Federal Reserve interest-rate reduction this month after a mixed November employment report. Yields on two-year notes, which are sensitive to central-bank policy changes, slid as much as seven basis points to around 4.08% and retained the bulk of their drop late afternoon in New York, after the data showed that job creation and the unemployment rate both increased last month. Traders are pricing in an approximately 80% chance of another quarter-point easing at the Fed’s December meeting, up from 64% before the data. The US economy generated 227,000 new jobs last month compared with an anticipated gain of 220,000. The unemployment rate unexpectedly edged up to 4.2%, and wages grew 4% year-on-year, more than economists estimated.

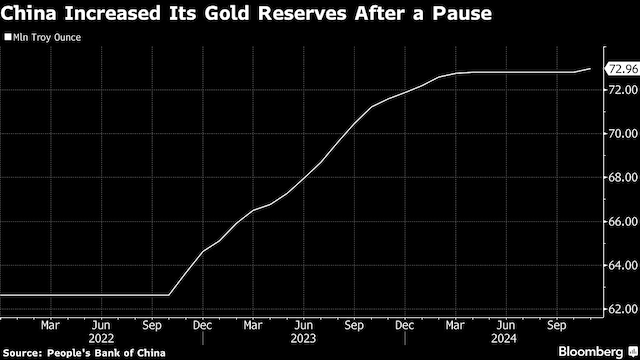

The People’s Bank of China added to its gold reserves in November, ending a six-month pause in purchases. According to official data released on Saturday, the Chinese central bank’s bullion stock increased 160,000 fine troy ounces last month to 72.96 million fine troy ounces. Despite record-high prices, China’s return to hoarding gold reflects an attempt to shore up ammunition to defend its currency from depreciation. The PBOC had added to its stockpiles for 18 consecutive months until April 2024.

Apple has spent years trying to replace the Qualcomm modem chip in its iPhones. One of Apple’s most ambitious projects, which was in the making for over half a decade, the in-house modem system will debut next spring, people familiar with the matter told Bloomberg. The technology is slated to be part of the iPhone SE, the company’s entry-level smartphone, which will be updated next year for the first time since 2022. A modem is a critical piece of any mobile phone, letting the device connect to cell towers in order to make calls and link up with the internet. Apple’s first version of the component will be followed by further generations that become increasingly more advanced. The company aims to ultimately overtake Qualcomm’s technology by 2027, Bloomberg’s sources added.

South Korean President Yoon Suk Yeol survived an impeachment vote on Saturday, as his ruling party refused to join an opposition bid to oust him after he shocked the nation by briefly declaring martial law. The impeachment vote failed to clear the 200-vote hurdle needed to suspend the president from duties, after the ruling party boycotted the vote. South Korean National Assembly Speaker Woo Won-shik banged the gavel to announce that “the voting cannot take place” because the quorum was not reached during a plenary session for the impeachment vote at the National Assembly in Seoul, South Korea, Saturday, Dec. 7, 2024. (Jeon Heon-kyun/Pool Photo via AP)

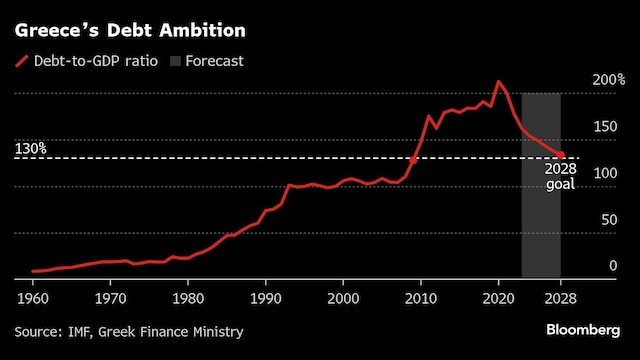

Greece’s rating status was upgraded by Scope Ratings, which cited strong growth and declining debt as the main drivers. The ratings firm on Friday raised Greece’s long-term sovereign rating to BBB from BBB-, while adjusting the outlook to stable from a previous positive, according to a statement. “Declining public debt, improved banking-system resilience and stronger trend growth drive the upgrade,” Scope said. The continued focus on budgetary prudence “provides Scope with an increased confidence in the ability of government to achieve and sustain elevated primary-surplus objectives ahead of the next general elections barring unforeseen crises,” the credit assessor added.

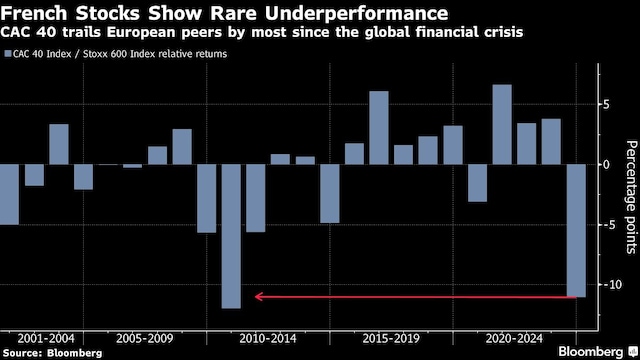

In a year when most of the world’s major stock markets handed investors double-digit returns, France’s CAC 40 Index is in the red, down 1.5%, heading for its worst year of underperformance relative to other European markets in over a decade. That’s in large part due to President Emmanuel Macron’s decision to call a snap general election in June. The failed gambit unleashed months of political infighting just as the country badly needed stable leadership to reign in a budget deficit that’s among the highest in Europe. With the government in tatters following a recent no-confidence vote and borrowing costs that recently surpassed Greece, ratings agencies are warning that France’s finances are now getting dangerously out of control. “The situation could degenerate if the deficit or even projections of the deficit show a deterioration,” said Claudia Panseri, chief investment officer for France at UBS Wealth Management. “I think that insurers and banks will continue to underperform.”