| Company | Value | Change | %Change |

|---|

The Finance Minister has however clarified that reports of recommendations by the GoM on rate rationalisation are premature and speculative. Since GoM is a recommendatory body, the final decision will be taken only by the GST Council.

This article examines the potential effects of this proposed rate change (if implemented), its impact on GST implementation, and the clarifications required from the government for a seamless transition.

An overview of the proposed 35% GST slab

The introduction of a 35% GST rate on tobacco, tobacco products, and aerated drinks has been proposed primarily for two reasons — promoting public health and enhancing government revenue. These goods are classified as demerit products due to their harmful effects on health. The 35% rate, being in the higher bracket of GST, aligns with the government’s goal to discourage consumption of such products. Additionally, it aims to increase revenue from items that typically exhibit inelastic demand, meaning that even with higher prices, consumption may not drop significantly.

Fiscal measure coupled public health intervention

The increase in the GST rate on tobacco and aerated drinks is not only a fiscal measure but also a public health intervention. Tobacco consumption and sugary drinks contribute significantly to lifestyle diseases, including cancers, diabetes, and obesity. By imposing higher taxes on these products, the government hopes to reduce their consumption, especially among price-sensitive consumers, and promote healthier alternatives.

From a fiscal perspective, the higher tax rate is expected to generate substantial revenue, especially since demand for these products is relatively inelastic. Inelastic demand means that consumers will continue purchasing these goods even at higher prices, ensuring a stable revenue stream for the government. This could also potentially reduce the reliance on compensation cess, which was originally introduced to cushion states’ revenue losses following the GST implementation.

Furthermore, the imposition of a higher tax rate aligns with global trends of using sin taxes to discourage harmful consumption. Several countries have already implemented higher taxes on products like tobacco and sugary drinks to curb their adverse health effects. Therefore, India’s proposed change fits within a broader international framework for health-centric tax policies.

Multiple tax slabs adding to confusion

This step may also complicate the GST system, which is already based on multiple tax slabs. Currently, GST operates under a framework with tax rates of 5%, 12%, 18%, and 28%. The introduction of a 35% tax slab would increase the number of tax categories, potentially creating confusion for businesses and tax administrators. Questions will arise about how to classify products that may fall into grey areas, such as flavored beverages or nicotine substitutes.

Clear guidelines must be provided to define what constitutes “aerated drinks” and “tobacco products” for GST purposes. This will help businesses in these sectors avoid confusion and ensure that they classify their products correctly under the new slab.

Enforcement and compliance challenges

One of the significant challenges associated with implementing a 35% GST rate is ensuring proper enforcement and compliance. The tobacco industry, in particular, is vulnerable to tax evasion and illicit trade. As the government increases the tax rate, businesses may face greater temptation to evade taxes, and the rise in taxes could lead to an increase in the smuggling of tobacco and related products.

To address these issues, the government must bolster its enforcement mechanisms. Measures such as track-and-trace systems, tighter surveillance, and audits should be introduced to monitor the movement of goods and ensure businesses comply with the new tax regime. Additionally, penalties for non-compliance should be made more stringent to deter illicit activity.

Transitional provisions:

Many businesses will be affected by the change in the GST rate, particularly those with existing inventories. The government should clarify how such inventory will be handled, and whether businesses will need to update the MRP (Maximum Retail Price) on existing products. This will prevent disputes and help businesses transition smoothly to the new rate.

Impact on other sectors:

The introduction of the 35% rate could create pressure government for similar tax increases on other sectors. For example, products with similar health or environmental impacts, such as plastics, Junk food, Electronic Waste, Vape and E-Cigarettes may face similar taxation changes.

The government needs to clarify whether other sectors will be impacted by the new slab in future.

Ideal GST slabs

Globally, following VAT/GST rates are prevailing in the developing Countries: Canada: 5%, Japan: 10%, Singapore: 9%, Sri Lanka: 18%. From a tax policy perspective, India’s GST structure could benefit from further rationalisation. Currently, the system features multiple slabs—5%, 12%, 18%, and 28%—which can create confusion for both businesses and tax administrators. To simplify compliance and enhance transparency, the government could consider consolidating the 12% and 18% slabs into a single middle tier. This would reduce the number of slabs to three: 5%, 12% (or 15%), and 35%. Such a move would streamline the tax structure, especially for SMEs, while still addressing the needs of essential goods and luxury items.

For equity, essential goods like food, medicine, and education could remain taxed at lower rates or be exempted altogether, ensuring that they remain affordable for the masses. On the other hand, luxury and harmful goods, such as tobacco and alcohol, could continue to be taxed at higher rates, aligning taxation with public policy goals, such as reducing consumption of harmful products.

Extension in compensation cess necessary?

The GST Compensation Cess was introduced to compensate states for revenue losses during the transition to the GST system. Initially designed to last for five years, its extension until March 2026 was implemented to address the revenue shortfalls caused by the COVID-19 pandemic. This cess is applied to luxury, sin, and demerit goods, with the funds being distributed to states based on their losses.

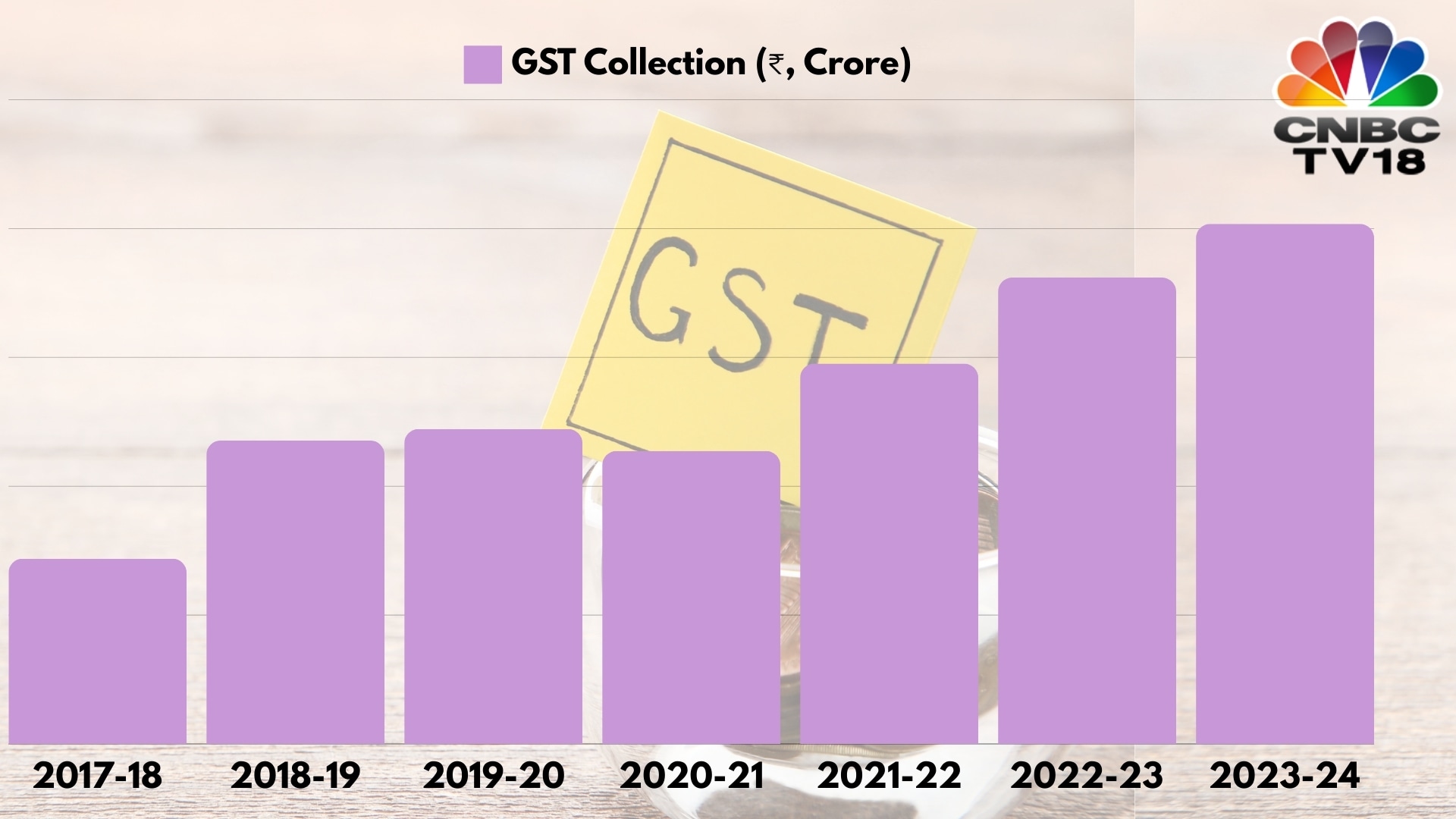

However, the extension of the GST Compensation Cess beyond March 2026 raises concerns. If the states have been adequately compensated for their losses, continuing the cess may no longer be justified. Prolonging it could undermine the credibility of fiscal policy, add inflationary pressures, and place a burden on both businesses and consumers. Given that GST revenues have stabilised, with this new slab of 35%, GST council must decide and eliminate CESS by March 2026.

Conclusion

The proposed increase in the maximum marginal rate of tax to 35% for tobacco, tobacco products, and aerated drinks is an important step toward improving the overall GST structure in India. It aligns with the government’s goals of promoting public health, rationalizing the tax system, and generating additional revenue. However, this change could lead to increased complexity in the GST system, requiring careful planning and clarification from the government to ensure smooth implementation.

Ultimately, the introduction of the 35% tax rate could pave the way for future rationalization of the GST structure, reducing the number of tax slabs and simplifying compliance. However, this must be done gradually and with careful attention to the needs of businesses, especially small and medium-sized enterprises (SMEs), which may face increased compliance costs.

By clarifying the classification of goods, addressing transitional provisions, and ensuring that tax evasion risks are mitigated, the government can ensure that the new tax rate achieves its intended goals without creating undue burdens on businesses or consumers. In the long term, the success of this adjustment will depend on the government’s ability to balance public health concerns with economic efficiency and fiscal stability.

—The author, Rajat Mohan, is Senior Partner at AMRG & Associates. The views are personal.