Source: Deloitte India

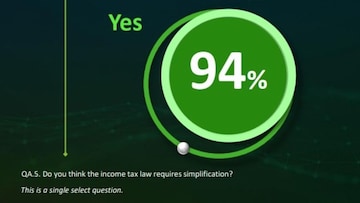

The survey, which gathered insights from over 320 business leaders, reveals that over 70% of small businesses face difficulties with the current tax reporting complexities, highlighting the need for simpler processes. In particular, 43% of respondents pointed to the necessity of better mechanisms for resolving tax disputes.

Dinesh Kanabar, CEO of Dhruva Advisors, has noted the ambiguities in current tax regulations, especially in mergers and acquisitions, which often lead to unintended interpretations and disputes.60% view tech-driven reforms in ITR filing as ‘highly successful’

Among the most praised recent reforms were initiatives like the Annual Information Statement (AIS) and Taxpayer Information Summary (TIS) tools, which have simplified the tax return filing process. Nearly 61% of respondents viewed these tech-driven reforms as highly successful in promoting higher voluntary compliance, with the number of tax returns filed rising over the past two years.

Recommendations for tax reforms

Key recommendations from the survey include the introduction of clearer tax guidelines, faster dispute resolution, and streamlined procedures for filing returns. Industry leaders also emphasised the need for targeted tax incentives to boost domestic manufacturing, innovation, and R&D, areas identified as crucial for India’s future economic expansion.

As the government seeks to make India’s tax system more business-friendly, these findings align with ongoing efforts to modernise the framework in anticipation of the 2024-25 Union Budget.

Also Read : Insurance trends 2024: Health claims surge by 30%; heart diseases lead term insurance claims