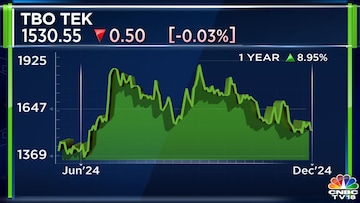

| Company | Value | Change | %Change |

|---|

According to TBO Tek, travellers are increasingly planning their trips around specific activities and experiences rather than destinations.

“In fact, it’s already happening—you think of what you want to experience, and then you decide where to travel to,” said Co-Founder and Joint Managing Director Gaurav Bhatnagar.

This potential shift is the foundation of TBO Tek’s strategy to expand its ancillary services, which include experiences, transfers, and car rentals.

Currently, these ancillary offerings contribute a small portion to the company’s overall revenue, but they are growing rapidly, he said.

Ankush Nijhawan, Co-Founder and Joint Managing Director of TBO Tek, pointed out the rising margin pressures, particularly in the airline segment, even though both the air and hotel verticals remain healthy.

Read Here | Travel platform TBO Tek to focus on expanding hotels business

Nijhawan also discussed the details of the recent sale of stake in the company by private equity players.

Augusta TBO (Singapore) Pte, which offloaded 40.74 lakh shares of TBO Tek at an average price of ₹1,465.14 per share, reducing its stake by 3.75%.

TBO Korea Holdings sold 23.05 lakh shares, representing a 2.12% stake.

Currently, Augusta TBO and TBO Korea hold a 15% stake in TBO TEK, following a 6% sale on December 3.

“They are private equity players. They invested in the company quite a few years ago, and they had come in at a significantly lower valuation back then. So we are not surprised that they chose to do the block yesterday. What we are happy about is how the market has reacted to it. Even though the trade happened about 7-8% discount to the previously traded price, we were pretty much back,” Bhatnagar said.

Brokerage firm Jefferies initiated coverage on recently-listed TBO Tek, with a buy recommendation and a price target of ₹2,000 per share.

TBO focuses on providing travel inventory to travel agents and other B2B partners, majorly dealing in offline or assisted travel markets.

The company, which has a market capitalisation of ₹16,580 crore, has seen its shares rise 8% over the last six months.