| Company | Value | Change | %Change |

|---|

Sector-wise, heavyweights in energy, metals, and banking drove the rally, while defensive sectors like FMCG and pharma showed subdued performance. The broader market too have been showing strength with both mid and smallcap indices making gains for the last eight consecutive trading days. Most of the sectoral indices ended in the green.

The FMCG index declined by 0.4% amid reports of likely GST hike on products such as aerated beverages, cigarettes and other tobacco-related items to 35% from the current 28%.

Financials outperformed, with the Nifty Bank rising over 1%. HDFC and Axis Bank were the top gainers. Adani Group stocks were among the top Nifty gainers, with Adani Ports rising 6% and Adani Enterprises gaining 3%.

Shares of Granules India Ltd. slipped 10% after the company’s Gagillapur facility in Telangana has been classified as Official Action Indicated (OAI) by the United States Food and Drug Administration (USFDA). In September 2024, the USFDA had issued a form 483 with six observations for the Gagillapur facility. An OAI status means that a facility has objectionable conditions or practices that require regulatory or administrative action.

Foreign institutions tuned net buyers in the cash market on Tuesday, while domestic institutions were net sellers.

Moving forward, the market will watch out for the US job openings data and November services PMI data of India and the US, which will be announced Wednesday.

Analysts expect markets to gain some momentum in the near term on the back of positive global cues, optimism around enhanced government spending and favourable monetary policy changes by the RBI.

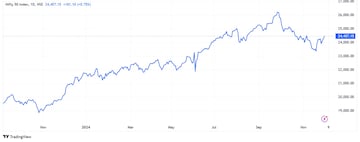

What do the Nifty50 charts indicate?

The Nifty continued to advance for the third consecutive sessions on December 3 and closed the day with another decent gains of 181 points. A range bound action was witnessed with positive bias in the mid to later part of the session and the Nifty closed at the highs.

The Nifty is now placed at the edge of breaking above the crucial hurdle of around 24,350-24,500 levels, which were previous swing highs.

According to Nagaraj Shetti of HDFC Securities, the underlying trend of the Nifty continues to be positive. A decisive move above 24,400-24,500 levels is expected to open the next upside of around 24,900-25,000 levels in the near term. The immediate support is at 24,300, as per the concept of change in polarity.

For day traders, Shrikant Chouhan of Kotak Securities said that 24,350/80,500 and 24,250/80,200 would be key support zones. As long as the indices are trading above these levels, the bullish sentiment is expected to continue. On the higher side, the market could move up to 24,600-24,625/81,500-81,700. However, if it falls below 24,350/80,200, Chouhan advised traders to exit their long positions.

As per Om Mehra of SAMCO Securities, the Nifty shows a bullish outlook as it holds above the 40 EMA and inches closer to the 50 EMA. The daily RSI has rebounded to 55, indicating improved momentum. He said the support remains at 24,280, while resistance is placed at 24,600, followed by 24,650.

With Nifty surpassing the 24,350 resistance, sustained momentum could drive the index toward the 24,700 mark, Ajit Mishra of Religare Broking recommended investors to adopt a ‘buy on dips’ strategy for the index.

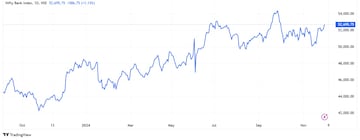

What do the Bank Nifty charts indicate?

The Bank Nifty began on a positive tone, continued buying interest, and closed on a strong note at 52,695.75 levels, registering a gain of 1.13%, and decisively surpassing the critical resistance of 52,500.

“The index formed a bullish candle, signalling sustained upward momentum, potentially bridging the gap toward 52,818. Notably, it climbed above 61.8% Fibonacci retracement level at 52,680, positioning towards the next resistance at 53,000, followed by 53,450 at the 78.6% retracement level A sustained bullish trend is evident on the hourly chart, and the daily RSI remains steady around 60. The immediate support remains at 52,400, providing a cushion for any potential pullbacks,” Om Mehra said.

If the Bank Nifty index maintains above 52,500 levels, then it may approach towards 53000-53,500 levels, said Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Interrmediates.