NTPC Green Energy shares surge 10% in their first upper circuit post listing

Shares of NTPC Green Energy Ltd., the recently listed subsidiary of state-run NTPC Ltd. are locked in a 10% upper circuit on Tuesday, December 3.

This is the first upper circuit that the stock has seen post its listing on November 27. The stock currently trades under a 10% price limit. Out of the five trading sessions that the stock has had, the stock has ended higher in four of them. With Tuesday’s move, shares of NTPC Green Energy have risen 31% above their IPO price of ₹108. The stock now has a market capitalisation of ₹1.2 lakh crore post this five-day upmove.

Varun Beverages shares fall as much as 5% on CNBC-TV18 report of potential GST rate tweaks

Shares of Varun Beverages Ltd., one of the largest bottling partners of food and beverage giant PepsiCo Ltd., declined by as much as 5% in Tuesday’s trading session.

The sharp fall in the stock price followed a CNBC-TV18 reported about potential rate rationalisation in the upcoming GST council meeting.CNBC-TV18 reported on December 2 that the Group of Ministers (GoM) have decided to propose a 35% special GST rate on aerated drinks, along with Tobacco and Tobacco products. The sources further said that the 35% rate will be over and above the existing four slab structure of 5%, 12%, 18% and 28%.

Swiggy Q2 Results LIVE: Stock cools off from day’s high ahead of earnings announcement

Swiggy Q2 Results LIVE Updates: Food delivery aggregator Swiggy Ltd. will be reporting its first quarterly results after it became a public company last month on Tuesday, December 3. The results will also be in focus specifically for the profitability parameter and the fact that the company’s shares have run up significantly ahead of the results. The stock now trades at levels of ₹500, well above its IPO price of ₹390. Multiple brokerages have also come out with reports on Swiggy and its prospects going forward. Alongside the results, management commentary on instamart, genie and other aspects of the business will also be watched for, specially because of the rapid growth in the quick-commerce space and the expansion plans of Zomato’s Blinkit. We will keep you posted on all the live updates right here.

#TechTalks

Nikhil Kamath reflects on the transformative potential of AI in addressing real-world challenges

My recent conversation with Yann LeCun (French-American computer scientist) was like peering into the vast possibilities of the future, where artificial intelligence isn’t just a tool but a force reshaping every aspect of our lives. For me, it raised a question — What does this mean for entrepreneurs, especially in India, a country with potential but with unique challenges of its own?

Yann’s perspective on AI — its history, capabilities, and what it can do next—was both enlightening and grounding. At its core, AI is about creating and amplifying intelligence, but the true magic lies in applying it to solve real problems. It’s easy to romanticise AI as a mystical force that will change everything overnight, but as Yann said, AI is a tool, not a wizard. Its impact depends entirely on how we use it, and for entrepreneurs, that starts with identifying the right problems.

Intel CEO retires, company appoints two interim co-CEOs as it hunts for a full-time replacement

Intel CEO Pat Gelsinger has retired, with senior leaders David Zinsner and Michelle Johnston Holthaus stepping in as interim co-CEOs. Gelsinger, who had a career lasting over 40 years, has also resigned from the company’s board. Intel announced that a new full-time CEO will be appointed soon.

Frank Yeary, the board’s independent chair, will serve as interim executive chair during this transition. Yeary said they will shortlist the next CEO based on their ability to improve product leadership and restore investor confidence.” While we have made significant progress in regaining manufacturing competitiveness and building the capabilities to be a world-class foundry, we know that we have much more work to do at the company and are committed to restoring investor confidence … Ultimately, returning to process leadership is central to product leadership, and we will remain focused on that mission while driving greater efficiency and improved profitability,” Yeary said in a post on Intel’s official website.

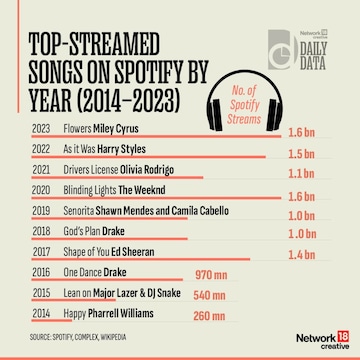

#DailyData

#PersonalFinance

Air India Frequent Flyer Programme is now Maharaja Club: Check eligibility and how to use

Launched in 1994 as Flying Returns, Air India’s frequent flyer programme is one of the oldest in India. With the recent merger of Air India and Vistara, their frequent flyer programmes have combined into a new version, Maharaja Club.

This updated programme offers various benefits to members, whether they fly often or occasionally. Here are few ways to maximise the benefits of Maharaja Club. Eligibility for Maharaja Club: You need a valid email address and mobile number to join the account. The programme is open to anyone who meets this basic criterion.

Why banks end co-branded credit card partnerships: Key reasons explained

Co-branded credit card partnerships have long been a popular strategy for banks and financial institutions to expand their customer base and offer specialised products. However, RBL Bank’s recent decision to cease the issuance of new co-branded credit cards with Bajaj Finance highlights that such partnerships can come to an end for various reasons. Let’s delve into the factors that drive banks to rethink and terminate co-branding agreements.

Changing synergies between partners

One of the most common reasons behind the termination of co-branded partnerships is that the initial synergies between the partners no longer exist. According to RBL Bank’s announcement, after discussions with Bajaj Finance, it became clear that the synergies from the partnership had shifted over time.

#ExpertEdge

40 years of Bhopal gas tragedy — what India has learnt from the world’s worst industrial tragedy

The Bhopal gas tragedy, which occurred on the night of December 2-3, 1984, remains one of the worst industrial disasters in history. It took place at the Union Carbide India Limited (UCIL) pesticide plant in Bhopal when a toxic gas leak, primarily methyl isocyanate (MIC), released into the atmosphere, leading to widespread deaths, injuries, and ecological damage.

The leak had killed several thousands and left behind a legacy of health problems—both mental and physical. The tragedy brought global attention to the dangers of unregulated industrial productions and lack of safety measures. The survivors’ ‘fight for justice’ has been a vital component of the country’s legal and socio-economic system. The Bhopal gas tragedy is a grim reminder of the catastrophic potential of industrial accidents and the need for vigilance and foresight in industrial operations.

SIP vs Active Fund Management — which one is better

When it comes to investing, one of the most common dilemmas for individuals is choosing between Systematic Investment Plans (SIPs) and active fund management. Both strategies cater to different investment philosophies and investor goals.

Understanding SIPs and Active Fund Management

A SIP is a disciplined approach to investing, where individuals contribute a fixed amount at regular intervals into mutual funds, typically equity-based. This strategy leverages rupee-cost averaging, allowing investors to buy more units when prices are low and fewer units when prices are high, thereby mitigating the impact of market volatility. Additionally, SIPs inculcate financial discipline, making them a popular choice for long-term wealth creation.

We’ll see you tomorrow with another 11:11