Investors hoping for outsize gains over the next year may look toward Nvidia (NASDAQ: NVDA). Nvidia dominates the semiconductor market when it comes to chips designed for artificial intelligence (AI) purposes, and even with the stock’s massive move higher, analysts project further upside over the next 12 months.

However, stocks often fail to meet analyst expectations, and a 200% increase over the last year should rightly leave investors questioning how much more near-term upside they might have with Nvidia stock. Hence, investors should take a closer look before deciding whether to buy.

Nvidia analyst recommendations

Nvidia stock trades at just under $500 per share. It has been among the best performers of 2023 amid heightened interest in AI and the company’s ability to support that technology.

According to Tipranks, 34 different analysts have published 12-month projections for Nvidia stock. The estimates range from a low of $560 per share to as much as $1,100 per share. Under the worst-case scenario, Nvidia stock will rise 13%. The best-case scenario would take the stock almost 225% higher, surpassing the impressive performance of the last 12 months.

Nonetheless, the average price target of just over $661 per share implies a 33% upside over the next 12 months. As mentioned before, analysts can be wrong. Still, over the past month, 15 of the 34 analysts highlighted in Tipranks have reiterated estimates, a reflection of how closely they watch the AI stock.

Nvidia’s financials

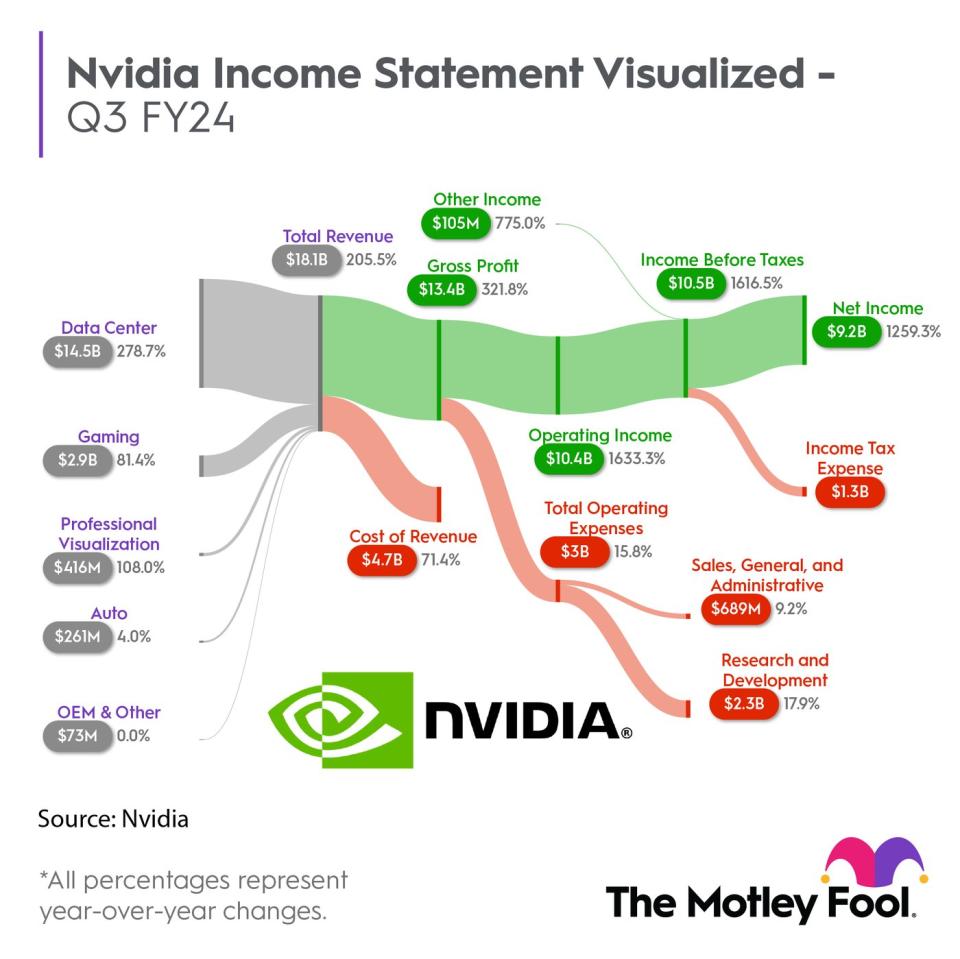

Admittedly, the recent financials appear to more than back up the hype. In the third quarter of its fiscal 2024 (ended Oct. 29), Nvidia achieved record quarterly revenue of more than $18 billion. This was up 206% year over year and 34% from the previous quarter.

Also, since the rise in operating expenses was comparatively modest, net income totaled $9.2 billion. In the year-ago quarter, Nvidia earned only $680 million. That’s an almost 1,260% increase!

Moreover, if Nvidia meets its expected $20 billion in Q4 revenue, it will experience a yearly increase of 231%, exceeding the current growth rate. Furthermore, the effects on valuation may not be as significant as some might assume, depending on how investors measure it. Currently, it supports a P/E ratio of about 65, a level not far above three-year lows.

Still, the picture looks different when measured by price-to-sales (P/S) ratio. The stock currently sells at about 28 times sales. While the P/S ratio was higher recently, that takes it far above the level of Advanced Micro Devices or Intel, which could price Nvidia for perfection.

Will Nvidia meet the price target?

Given Nvidia’s recent performance and massive revenue and earnings growth, it could meet its price target. Many investors will likely buy, considering that even the worst-case scenario calls for the stock to closely approximate the S&P 500’s average growth.

However, the P/S ratio indicates the market has priced Nvidia stock quite richly. Indeed, the revenue and earnings growth rate may look like perfection to some shareholders.

Nonetheless, given the highly positive view on the stock, perceptions will probably change for the worse if they change at all. As for how to invest in Nvidia stock, new investors may want to proceed cautiously, wait for a lower valuation, or consider a lower-cost stock in the same industry.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of December 18, 2023

Will Healy has positions in Advanced Micro Devices and Intel. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Analysts Forecast More Than 30% Upside for Nvidia. Is the Stock a Buy? was originally published by The Motley Fool